True Profitability then Sizing Up Too Fast - The Struggle is Real

Reflections and journaling on the past week and looking at the Nasdaq 100 for the next week. Things are going well - kind of!

Welcome all new subscribers and followers! I’m honored you’ve chosen to check out my Substack! To kick things off, I put a huge amount of effort into this post, and I really enjoy reflecting on the week, so I hope you can find something of value here.

How it (Friday) started:

How it (Friday) went:

Me being an absolutely annoying menace to the legendary Retail Capital - a required follow for Twitter. His substack is great too:

Fortunately (or not) the 2 NQ tweet wasn’t a joke. I was sitting in that trade. More on that later.

Friday’s Session

Wow. What a session! Initially, after giving some small papercuts back in A and B periods, but still up 25p on my Apex account, I was actually thinking of being done for the day, assuming this would be another classic trappy / choppy Friday (thus my first tweet above - was totally ready to walk away from the session).

However, I started to notice (at least on MNQ delta, NQ was a bit wieder) that there was heavy selling, but no progress below yesterday’s low of day (PLOD). This can (but not always!) lead to a decent squeeze. Man was that an understatement. As B period started to rocketship upwards, I thought, okay, classic standard trend up day, but I’m done, don’t even need to observe. But after dinner, I couldn’t help myself to check in on the session, and I just kept seeing that the aggressive bidding wouldn’t stop.

Slowly, I started realizing this was a session I had to lean into, for a few reasons:

All periods, A, B, C, and D so far were upward rotations (read: green 30-minute candles)

The move in E period far exceeds the initial balance, and is much larger than C period - E period is typically one of the slowest in the session, so seeing this very bullish price action at this time of day is a huge bullish signal IMO

My trade models were no longer giving any suggestions, despite the price action of near-constant higher highs. this was telling me we were in uncharted territory, at least for recent trading sessions (my models typically use sessions from about the past year)

When these sorts of signals started to align, I couldn’t help but get involved. Strangely, for the first time in a long time, I decided an option might be a nice way to play it, because as long as the general move was ‘up’, I’d get paid, not having to monitor or micromanage any stop as I would need to with futures for the all-to-common classic NQ style pullback on trend up days. I have a small TD Ameritrade account (mainly so I can use their API 😂), but I decided to buy an ATM QQQ call. My expectations were far exceeded: my call went from 0.64 to 1.36, more than doubling my initial investment as a nice 10-bagger:

Of course, I realized could have held waaay longer, and this is where the whole mental struggle begins. I decided to hop into my personal futures account and up my size (again, following the thesis that I was watching a very big day unfold). However, this then started my first bad trade of the day. My algo and models were showing only short signals in E period. Despite my bullish bias, I’ve been killing it using my algorithms suggestions, so I begrudgingly took a short in F period. I failed to realize that I was finding 1-2 examples at maximum, which isn’t statistically significant at all. Still, like a total genius, I decided to fade the slow price action in F period, thinking it was absorption at the top of the day. After being stopped out here, I found myself going into my risk settings, boosting up the max loss to $750, and enabling NQ. I flipped long with 2 NQ, essentially with the mentality that the stop outs were telling me something (that shorting was not the correct trade, even that high above the IB high). This trade ultimately did pay after about 2 hours and I finally got my stupid gap fill at 15150:

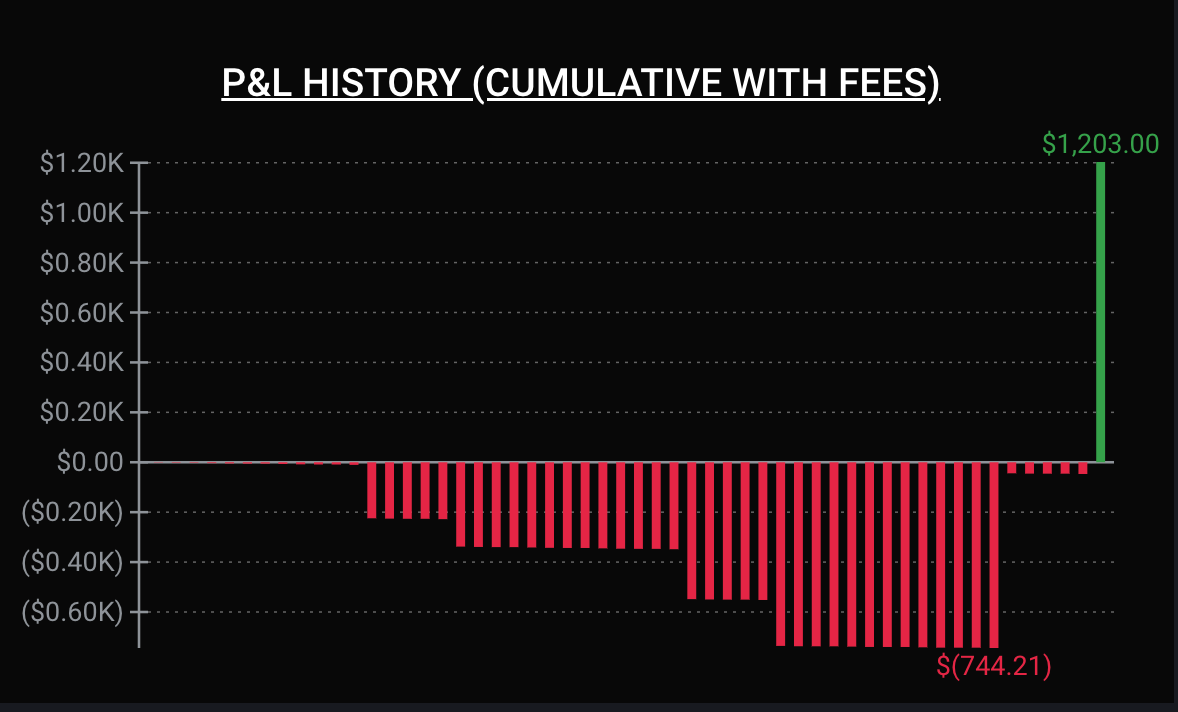

Since I want to always be fully transparent, ultimately, my PNL ended up looking like this:

Seems, great, right? Green on the day! Wrong. I broke nearly every single one of my rules in Friday’s session:

More than 1 trade on a given setup, in other words, revenge trading on the 4 MNQs (flipping long nearly immediately after stop)

Waaay more size than 1 lot MNQ (20x to be exact - stupid)

Slid profit target to gap fill level, more than 10p beyond my normal target of 50p

Didn’t journal this trade (the most stupid in my opinion, was completely flying under the radar with leverage and no true idea of the probability)

So, was I green on the day? Yes, green on all different trading accounts, a first in a while for me. But I’ve been realizing, on those days where it feels like you got away with something, (specifically my 2 lot NQ trade) I know I did something wrong and against my process. To be honest, I wasn’t following my model / algo the best I could, and by the late afternoon, the signals were drying up entirely. All I really had to go on was that gap fill at 15150 and assume that it would be hit. While hoping for more profits is a decent mental model in trading, simply stubbornly picking a value because you assume the market will reach it is pretty stupid. This was again my bad habit of sliding profit targets beyond their original values, which you can read more about in this post.

Really, the fact that anyone anywhere can make $1200 in one day - let alone a few hours - is an absolute blessing. $1200 is a more than a month’s salary for more than 88% of the world, and I made that in about 2 hours. After showing my good friend this trade, however, he immediately looked beyond the money and asked, “but… isn’t this a rule break?” I’m blessed to have friends like this who can keep me in line - I obviously can’t do it by myself right now. And he’s 100% right. In less than a week, I’ve already strayed from the “strict” rules I set for myself just last week. I know if I can’t get these rule breaks under control then I can’t handle trading. But I struggle so hard sometimes when we get explosive days like Friday to not FOMO in (obviously failing this time). And, since I broke my rules with two contracts, I can welcome over an hour of lifting this evening :)

So, trading large size is seriously a case of Uncle Ben: “With great power comes great responsibility”, and right now I know I’m not fulfilling my role on the responsibility part. With as much willpower as I can summon, I must trade with 1 MNQ at least until my 100 trade challenge is complete and I can review the data.

Weekly Overall Review

So overall, I have mixed feelings for this week. The week started with huge positives. I finally have begun trading a good system, which I believe is profitable over time. I have an algorithm and models that give me probability-based signals based on historical data, and I combine this with reading order flow in real time primarily through cumulative delta. Trading my Apex account this week, my trading was so clean, cleaner than it’s ever been. Thursday, for example, was a perfect day win-rate-wise, I hit either 1R or 2R profit for all 4 of the trades I took, producing an equity curve that was but a dream to me just a few months ago:

This is 7R ($50 x 7) with no drawdown. With 20 trading days a month like this and you’ve got 7K - don’t know about you but that’s plenty to live off of at least where I live. Of course, not every day will be this perfect, but just look at that equity curve. This, at least for me, is true trading discipline on the highest level. I think now in probabilities for every trade, and only take those which have a 50% or more historical likelihood (in reality, 33% would be mathematically enough for a breakeven expected value over time), so this is my edge, a meager 17% above what I need for breakeven. But that’s all you need. After my big losses shocked me into gear last week, I think I’m finally starting to understand what real profitable trading looks & feels like. The funny thing is it’s less stressful than what I was trying to do before, forcing trades that weren’t even any strategy and (borrowing a phrase from Retail) sweating every tick, trying to react to every move up or down.

Of course, however, I get cocky after perfect days like this. I want to size up, I want to trade the big boy contracts, the ones I see all over socials and Twitter…

But I haven’t earned that right yet.

I just haven’t earned it.

That’s the phrase I’m taking into this coming week. No matter how slow or boring a single MNQ contract feels, I KNOW this is training that will set me up for the rest of my trading career. Only after the 100 trade challenge will I move to 2, then 4, then so on. Process above all, and the rest will follow - at least that’s what everyone says 😉 I don’t want to relapse into NQ at all until I feel 100% ready - and this should only be after we are well into next year.

Okay, that’s enough for the review and psychological side. Let’s talk about what I’m much better at - the technicals.

Recent Fridays

Recently, Friday sessions have been quite explosive in both directions. Let’s take a look AMT JOY plots for the past 3. Yesterday, which of course was a true trend-up day in every sense (including the Auction Market Theory definition of course), was a whopping 2.56% return, or 377 points from open to close:

After crossing the IB in C period (the orange dotted line), we never looked back for more than about 30-40 points, all the way until finally in M period with 50 points of some profit taking occurring.

Then, the Friday before that, September 22nd, was also an outside day, (I’ll talk a bit more about outside days below):

This day we saw initial bullish price action, but buyers failed to keep us above the IB high, leading to a liquidation in the afternoon. Most notable was the (perhaps options driven?) squeeze in L period which looked above the IB high, and immediate reversal liquidation in M period, with M period closing below the IB low. A truly extreme session full of fantastic trading opportunities from start to finish.

Outside Days

Yesterday was an outside day (both a lower low and higher high made during RTH). These days are rare in general for MNQ; only 20 of the last 179 have been outside days (just over 10%). The most recent one (not including yesterday), was Friday, September 22nd, that neutral extreme down Friday session shown above. Before that was just two days prior, on Wednesday, September 20th - the September FOMC day:

Link: https://amtjoy.com/session-lab/mnq/2023-09-20/

This was a textbook trend-down day, even during the volatility of the rate decision and press conference, where breaks below the IB low (and thus shorts) would have paid handsomely. This was an ugly close, with M period nearly unidirectionally down and taking up almost 100 points in range in a single 30-minute rotation!

Next Week

So, after yesterday’s emotional session to the upside, let’s look where we’re at on the daily:

Ok. A huge recovery after wicking off that 14650-14450 area for about the 5th time, and breaking out of what was a balance zone for the last 2 weeks. We are closing more or less just inside the previous range area established at the end of September, and just barely back into the value explored before (and during) the September FOMC.

We’re in an interesting spot, with multiple possibilities that could play out. The question I would guess everyone is asking is if this was a huge bull flag, or (my current bias) is that this was what the Market Huddle guys call a prairie dog - we look up and continue selling off in the coming weeks. But I’m no oracle so we’ll all have to find out together :) To be clear, there are only 3 possible outcomes:

We accept and continue to move upward and explore the balance zone from the first half of September

We look a bit above into this value area but reject back into the most recent balance zone of the past 2 weeks

We reject hard, break this 14450 area finally with conviction, and explore price levels not seen since May and earlier

Next week we have PPI on Wednesday and CPI on Thursday - so I think we’ll know by the close of Thursday or Friday which path is playing out. By next Friday we’ll also already be through half of the trading days in October! Crazy.

The sessions following an outside day which are also trend-up days follow through 50% of the time. More concretely, with AMT JOY I find only 4 such matches:

In fact, only one has a negative return on the session - but be careful, this was a strong trend down day. Looking at the data, the most bullish outcome on Friday seems to be a small to no gap up, with that gap filled quickly in A period (if any gap), and then continuation upwards.

Regardless it will be interesting to see how the market reacts as we explore inventory from the September FOMC.

A final comment: VIX is still elevated and above 17, and we nearly saw 20 print Friday morning. One “bad” economic print could easily get us back up to the high teens quickly. Stay safe out there.

Thanks, Questions, and Comments

If you’ve gotten this far, cheers, glad you’ve enjoyed the post so much! I’m hoping to post at least once a week with whatever valuable information (both technical and psychological) that I pick up throughout my week of trading.

Also, does anything sound like alien language? Is anything not making sense? (“B period? What the heck is that?”) I’d be happy to put together a post on everything I’ve learned about auction market theory in the coming weeks. It’s quite literally changing my life. I can also give some insights into how I built my system, how I think about trading, and how it has changed from the beginning of this year when I started this wild ride.

Great post! Would love a further explanation on your personal dictionary. Keep up the great work !

Yes put an explanatory post about the jargon/methodology. Good post mate & keep risk controlled