Here's That Auction Market Theory (AMT) Jargon Post

Alphabet soup... or just pure alpha? 😎 (Okay, sorry about that one)

Auction Market Theory - Theoretical vs. Practical

I’m going to skip the background and original guys who invented Auction Market Theory, or AMT for short. You can find that on many websites. It’s mostly credited to J. Peter Steidlmayer and James Dalton (Steidlmayer quite literally wrote the book on auction market theory - Trading with Market Profile!)

In this post, I’ll instead be focusing on the terminology and how I use it in my trading, in the least complicated way I can manage. In all reality, I don’t think it should take anyone more than an hour max to understand the basics of AMT (despite what the furus will try to sell you online!).

Let’s get started.

Disclaimer

I haven’t read Trading with Market Profile, and I’ve been told that this book is super complicated anyway, so take anything I say here with a grain of salt, but this is coming from a trader trading his own capital and staring at TPOs and 30-minute rotations day in and day out for the better part of 4 months now.

The Very Basics of AMT

Let’s start from the highest level.

AMT states that any market is a place for buyers and sellers.

These buyers and sellers are continuously determining what a fair price of an asset is. This concept, while simple, is quite powerful. For example, on Friday, October 6th, 2023, we sold off 100 points in the Nasdaq in less than 5 minutes on some “bad” news, but during RTH, market participants determined this price was extremely unfair, and we rallied back up to - and far beyond - the price before the selloff. The powerful thing about AMT is that its concepts apply to any market at any time, whether we are in a bull, bear, or balanced (neutral) market: a market is always just buyers and sellers trying to determine a fair price of the given asset.

The Letters - A, B, C, and So On

Regular trading hours (RTH), sometimes referred to as the Chicago cash session, are 6.5 hours in duration - 9:30 AM EST to 16:00 PM EST. This means that there are exactly thirteen (13) 30-minute periods (or ‘rotations’ as the cool traders say).

In AMT, we assign letters to each of these periods. The first 30-minute period is called A period, the second B period, and so on, all the way up to the final half hour of trading - M period.

Here’s a table to make it super clear, with some notes that I’ve made when I was first learning AMT:

(Sorry that it’s just a picture and not a real table - Substack apparently has no table feature yet! Sad!)

These letters can be charted on what is known as a Time-Price-Opportunity (TPO) chart. Think of any 30-minute candle chart - you would convert those candle ranges by overlaying the letter of the respect period, ‘A’ on the first half hour candle, ‘B’ on the second, and so on. Vertically, one letter is printed for a given number of points range in the asset, depending on the range. For ES this is typically 4 points, and for NQ this is typically 5. Here’s an NQ TPO for a trend up day:

KL

JKL

JKL

IJKLM

IJKLM

IJKLM

IJKLM

IJK M

I K M

I K M

I

I

I

I

I

I

I

I

I

I

I

HI

H

F H

F H

F H

F H

FGH

FGH

B FGH

AB FGH

AB FG

AB EFG

ABC EFG

ABC E

ABCDE

ABCDE

ABCDE

ABCDE

ABCD

ABCD

ABCD

ABCD

ABCD

ABCD

A CD

A CD

A D

A D

A D

A

A

Then, a true TPO typically has letters collapsed to the left, to clearly show the distribution of price over a session (which, at least to me, isn’t always super clear from the candles alone):

KL

JKL

JKL

IJKLM

IJKLM

IJKLM

IJKLM

IJKM

IKM

IKM

I

I

I

I

I

I

I

I

I

I

I

HI

H

FH

FH

FH

FH

FGH

FGH

BFGH

ABFGH

ABFG

ABEFG

ABCEFG

ABCE

ABCDE

ABCDE

ABCDE

ABCDE

ABCD

ABCD

ABCD

ABCD

ABCD

ABCD

ACD

ACD

AD

AD

AD

A

A

Initial Balance

The initial balance, or IB for short, is the range (NOT open to close, but the full range, low to high) of the first hour of trading.

In AMT terms, the initial balance is the full range determined by A and B periods. Both the nature of how the initial balanced is formed, as well as how price is distributed and explored after the initial balance is complete, can offer insights as to how the remainder of the session might play out.

What makes the initial balance so important?

The initial balance is so critical because of the amount of volume that is traded in this first hour of trading.

If the session begins to move decidedly away from the range determined by the first hour of trading (above or below), then one side of the market (buyers or sellers) have to otherwise try to fight the move, capitulate, and / or join in, and this can potentially lead to a continuation (think trend up or trend down days). Likewise, if we begin to move outside the initial balance, but the side that started the move doesn’t have enough conviction (typically in the form of low volume / no supportive delta), then it’s likely the other side can take over and bring us back into the initial balance, or even traverse the initial balance range completely to the other side! Finally, perhaps both buyers and sellers are too close in competition, and / or both are lacking conviction, so after the initial balance has formed, the initial balance itself defines the entire trading range for the entire session.

Intraday Session Outcomes

With AMT, there are only a few ways (5, for all intents and purposes*) an intraday session can play out, and they all relate to how price is explored after the initial balance has formed. The smart guys decided to make fancy names for each of these. For each ‘type’, I’m going to focus on the type of price action first and put the name after (the names are unfortunately NOT always very intuitive). Here they are:

The most ‘boring’ - the entire trading range is defined by the initial balance. That is to say, the high and low of the initial balance (A and B periods) are never crossed for the rest of the session, and as such we close somewhere within this range. Trades for these types of sessions should revolve around mean reversion strategies (short near highs of initial balance, long near lows of trading range). If by C, D, or E period we fail to break either side of the IB, this could be a signal that such a day is underway. These are called no trend days.

After the initial balance, we auction either above or below the initial balance, but ultimately there is not enough conviction from buyers or sellers in continuation, and we close somewhere back within the initial balance. These are called normal variation days and can have bias up or down (depending on what side of the initial balance we auctioned on).*

After the initial balance, we auction either above or below the initial balance, then traverse the entire IB range, crossing the other side, but then close somewhere back in the initial balance. These are called neutral days, which have no bias, because we close back inside the initial balance range.

After the initial balance, we auction either above or below, then traverse the entire IB range, crossing the other side, then closing on that side, outside the initial balance. These are called neutral extreme days and can have either up or down bias (depending on which side of the IB we close on).

And, the one Fintwit always likes talking about, the ‘trend’ day. Note that they have slightly different meanings from AMT and on socials like Fintwit. In AMT, for the definition of ‘trend’ day to fit, we simply need to close above or below the IB, without having crossed the other side of the IB. These are AMT technically trend days, with bias being whichever side dominates the session. Note that for the defintion to be valid, we can still have retracements close to the other side of the initial balance, but as long as we don’t cross it, and close somewhere above the other side of the initial balance, this is still a ‘trend’ day in AMT. (See meme picture above, despite the huge downward retracements, this was still wholey a trend up day for ES in the AMT sense.)

*The original AMT lexicon makes a differentiation between ‘normal’ and ‘normal variation’ days, in that the ‘normal’ days have a ‘smaller’ one-side break of the IB. But I’ve never been able to find what ‘smaller’ means, so I typically just always use the full ‘normal variation’ name. (Speaking to NQ / MNQ here, we rarely have only a ‘small’ break of the IB, so I think it’s a fair choice).

In my opinion, neutral and neutral extreme days can be the most lucrative for intraday traders, because the directional moves by definition have to be as large as the initial balance (which for NQ / MNQ is typically over 100 points on average), so there are huge point ranges and moves to take advantage of. Trend days can also be lucrative of course, but are in my opinion the most emotionally and mentally challenging, as to capitalize on them you need to both 1. get in early and 2. hold runners for the better part of 6.5 hours - a mental skill that takes many (including myself) a very long time to learn.

Okay… But How Can I Use This to Improve My Trading? An Example

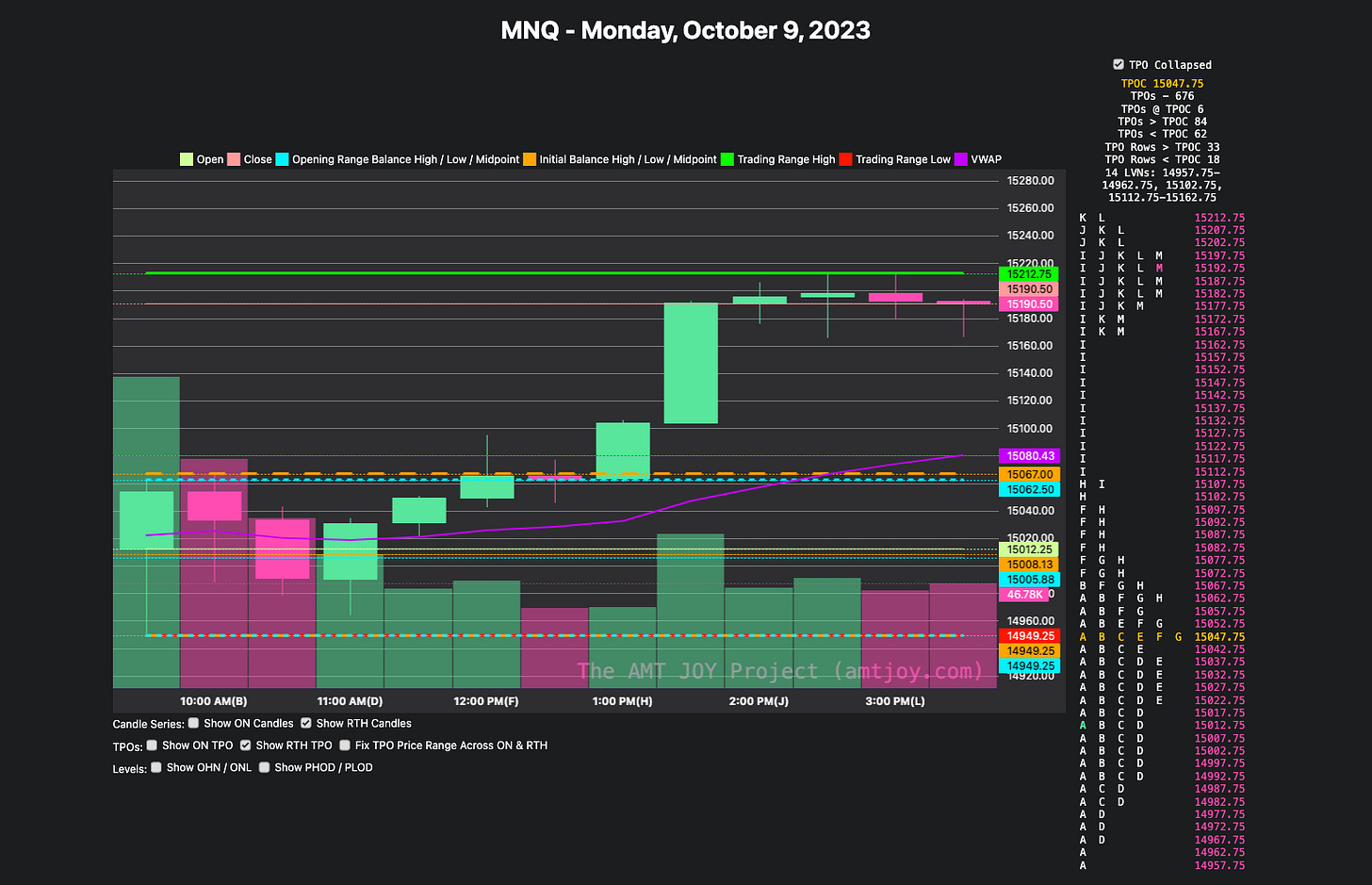

A recent session (at least when I started writing this) on October 9th, 2023 - AMT JOY link here - has a variety of valuable structures that are easiest to see using AMT and a TPO chart. Since I’m a quant nerd, my models have a way of generating these in the terminal. Here’s the uncollapsed TPO:

KL

JKL

JKL

IJKLM

IJKLM

IJKLM

IJKLM

IJK M

I K M

I K M

I

I

I

I

I

I

I

I

I

I

I

HI

H

F H

F H

F H

F H

FGH

FGH

B FGH

AB FGH

AB FG

AB EFG

ABC EFG

ABC E

ABCDE

ABCDE

ABCDE

ABCDE

ABCD

ABCD

ABCD

ABCD

ABCD

ABCD

A CD

A CD

A D

A D

A D

A

A

And the collapsed TPO:

KL

JKL

JKL

IJKLM

IJKLM

IJKLM

IJKLM

IJKM

IKM

IKM

I

I

I

I

I

I

I

I

I

I

I

HI

H

FH

FH

FH

FH

FGH

FGH

BFGH

ABFGH

ABFG

ABEFG

ABCEFG

ABCE

ABCDE

ABCDE

ABCDE

ABCDE

ABCD

ABCD

ABCD

ABCD

ABCD

ABCD

ACD

ACD

AD

AD

AD

A

A

And the 30-minute candlestick chart of the session, courtesy AMT JOY:

Excess

First off, we have excess in A period. These are those single prints at the very bottom of the TPO, and are quite common in A period as the US open quickly determines that the price set by the Asia and EU auctions (i.e. overnight session) is unfair. On bullish sessions like October 9th, 2023, these excess prints can act as strong support later on in the session, and you can see that attempts at sellers to bring us below the A period excess in D period was indeed quickly reversed.

Single Prints

In I period, we had a set of 11 single prints, as we filled the gap down created on the Sunday Globex open. Single prints often occur during gap fills, since there have been no buyers or sellers at those prices and as such no strong debate of price by market participants. There is also no inventory (positions at that level) from the day, so buyers or sellers don’t have any positions to push through.

Single prints indicate that price moved quite quickly through those levels. On trend days, they can be defended by buyers (on trend up days) or by sellers (on trend down days) in an attempt to keep any inventory trapped. If the session is not looking like a trend day, these single print areas are often revisited at least once, and often many times.

Excess vs. single prints? Sigh… I still get these confused from time to time. The easiest way to think about it that I’ve found is: excess is a form of single prints, but single prints within a TPO profile are not excess!

Distribution (Double Distribution)

We can see that Monday’s session was a clear example of a double distribution on the TPO. After the single prints in I period, we were seeing acceptance of price - from both buyers and sellers, above the I period single prints in J, K, L, and M periods. There is a trading style to scalp around these intraday distributions, but I’ve never tried it, nor does it fit my style.

Note that with the large average true range of MNQ / NQ, on really big days up or down, you may see as many of these distribution areas, paired with many sets of single prints - as much as 3 or 4 on those really big days!

AMT Session Types for NQ / MNQ

For MNQ, here’s a histogram of all the types of days in the past 179 sessions:

By count (without bias):

Trend - 95

Neutral Extreme - 26

Normal Variation - 39

Normal - 7

Neutral - 12

By count (with bias):

Trend, Up - 52

Trend, Down - 43

Neutral Extreme, Up - 16

Neutral Extreme, Down - 10

Normal Variation, Up - 14

Normal Variation, Down - 25

So, looking at this data, be careful what people mean when they say only 20% of days are trend and 80% are mean reverting. This is a social media statistic I have seen often, and since thrown out of my trading repetior. As we can see, trend days represent in fact more than half - 53% of the past 179 sessions (29% trend up and 24% trend down, respectively). Furthermore, I would consider a true “mean reverting” day only to be sessions that close back within the initial balance, i.e. no-trend, normal, neutral, or normal variation days, which combined only consist of up 58 of the last 179 sessions, or 32% of sessions. Just something to keep in mind if you want to get into trading MNQ / NQ.

So… You Want to Build a Trading System Around AMT?

My advice if you want to start incorporate AMT in your trading?

Start looking at how the AMT periods interact with each other as sessions develop on the instrument of your choice.

There are nearly an infinite number of research questions. For example:

If A and B periods are both upward rotations, what is the likelihood that C period is also up? Or that a trend day (close above the IB) is starting to form? Do the same for downward rotations.

If A and B are in opposite directions, does this have an effect on the likelihood for a trend day to form? Does it tend to lead to more balanced days?

How many single prints does a session have on average?

Start looking at every key level and how every period has interacted with them historically. What happens in A, B, C, D, and so on periods when we cross the previous day’s open? Previous day’s close? Previous day’s high (PHOD)? Previous day’s low (PLOD)? Overnight high? Overnight low? Initial balance high? Initial balance low? Trust me, you can definitely find at least a handful of 50%+ probability of profit trades - and that’s all we as retail traders need!

Doing this research, as well as starting to look at the TPO in conjunction with whatever other candlestick charts you are used to in realtime for every session, can potentially give you a whole new way to look at the market.

That’s exactly why I started building AMT JOY - to start getting a feel for how intraday sessions play out. Just click through all the charts there, noting the shapes of A and B period, the initial balance, and any other interesting structures you see in the TPOs.

Thank You!

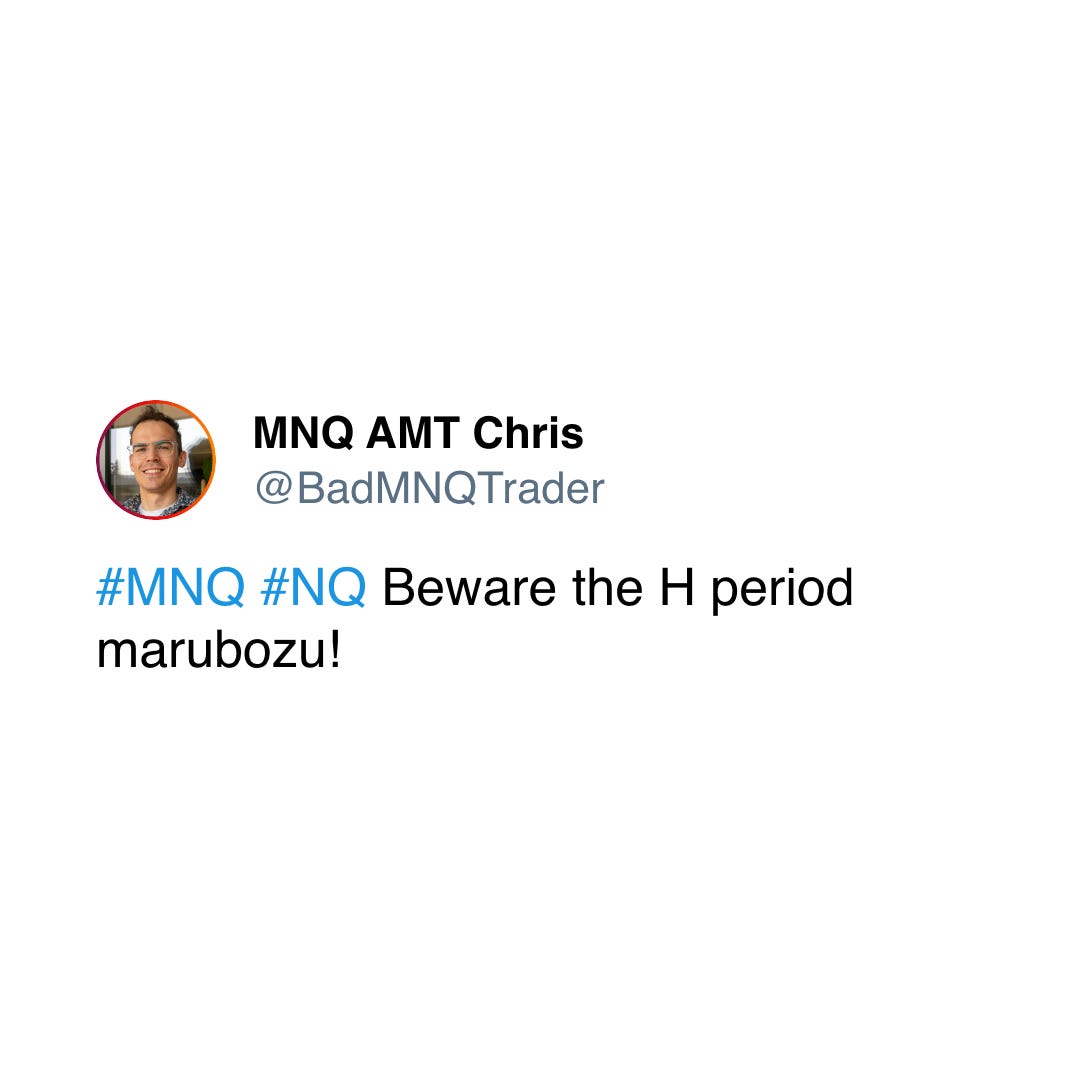

Whew, okay - maybe AMT is a bit more complex than I thought. 😅 Feel free to leave a comment if you have any questions and I’ll answer it as best I can. At least I hope now you’ll be able to half-understand when I post jargon like this:

(Okay, marubozu candles for another post…)

I still didn’t even get deeper into concepts like inventory, time point of control (TPOC), volume point of control (VPOC) (value), or the value area (VA) (and high / low, VAH, VAL) are yet! Teasers for a future post 😉

Cheers 🍻

-A Bad MNQ Trader