I wanted to actually write a post last week, that despite being green the first week in November…

I was trading like shit.

Closing winners way too early, especially on last Friday’s monster rally, getting stubborn against setups I was so sure would work, when ultimately, they didn’t. In short, I was doing everything backwards: not exploiting profiting trades and doubling down or overtrading ultimately losing trades.

I was green this week too, a total of being up 1.5K in November, finally making back that 5K I had lost in September. Naturally, since I finally made back my 5K, I decided to size up. Yes, me, the idiot, sizing up on the day of November OPX. In short, I lost all of that 1.5K made in November so far, and much more in one day:

After this gut wrenching session, I’ve decided to throw in the towel for the rest of the year. It’s just been too much. Here’s a rundown of my days recently:

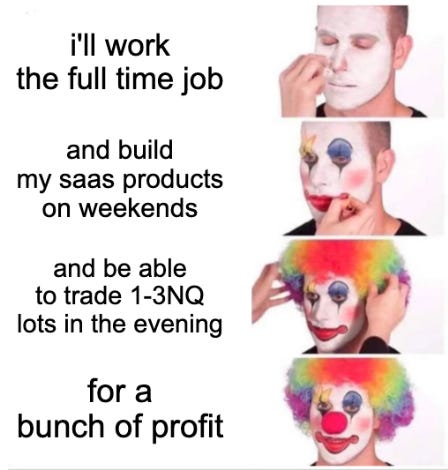

At work from 8-5

Come home, try to run models and get a few winning trades for the remainder of the session until 9 or 10 PM

Work weekends trying to improve my SaaS products, The Wheel Screener and AMT JOY

No time to even take a breath… and to think I could trade cleanly and with a clear head in such an environment, it’s pretty laughable.

It’s What You Know for Sure that Just Ain’t So

I’ve been thinking a lot about a Mark Twain quote, one that I’ve long known and really love but somehow failed to apply to my own trading:

It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.

I think the quote can be interpereted in two ways to be applied to my trading:

1. That even 60-70% are wrong 30-40% of the time - that’s a lot. There really is no “for sure” in trading. There’s no reason to get angry when a trade idea doesn’t play out. Just focus on the next one. I think my ego is so large and tied to my models, that when I find a setup or see a signal for 60% to 70% probability, I automatically treat it as 100%, and get pissed off when the trade doesn’t work. For anyone who follows me on Twitter, you probably have seen when I rage about these things - stuff that hasn’t been found in the last literal 1200 trading sessions happen on a daily basis. It’s true what the pros say - every session is like a snowflake, no two are alike.

2. Even when a trade is going my favor, I can’t start assuming or daydreaming about targets that I think will be hit, just from looking at a higher time frame chart. The market doesn’t guarantee you anything. To combat this, I think I have to start moving my stop to given take profit intervals as my position continues to go in my favor. Yeah, it sucks for a winning trade to fall back and close out at 50 points on something that ultimately goes to 100 points, but it sucks even more to have 75 points fall back to 0. I’ve always tried to follow Jesse Livermore’s phrase of “always […] keep what shows you a profit”, but I don’t think he ever traded NQ intraday :) Many, many times now I’ve tried to follow that rule, only to see thousands of dollars just fall back to 0. The Nasdaq is incredibly rotational, and a true clean trend day is the rarest of all. Maybe in hopes to make a compromise, I’ll always leave 1 lot of my position as a true runner, holding at least until power hour, to see if it really runs as far as I think it will. The rest I take off at precalculated targets according to my models.

A Changing Market

Now, I don’t want to blame the market, and perhaps I’m biased, but some movements recently have really been quite strange, not following “normal” market dynamics, at least in my opinion. It could be that I just don’t have enough screen time or experience with low VIX, but a lot of stuff has been happening that I’m not used to seeing (longs below IB / shorts above IB sometimes being the best trades of the day, OR breakouts not really producing moves further than 40 points away from the open).

Delta has also been incredibly hard to read as of late on NQ; it’s nearly been a fadable indicator recently. On Friday, some monster hidden buyer was keeping the market afloat, and while longing off the IB low was actually the correct trade for Friday, I found myself physically unable to long on the A, B, C, and D periods when I saw on delta that each one brings another 5000 contracts DOWN in delta each period. (However, to be fair - not trading against delta is one of my “rules” - but I think that rule may need revising soon). I think I may need to study balanced markets a bit more as well as sessions in sub 14 VIX environments.

^ November OPX

^ Idiotically poor high from a few days ago my models told me would (with 6 sigma probability) be cleaned up in power hour (it wasn’t, -25 NQ!)

The most excruciating from Friday? I had 2 NQ on during the afternoon rally and was so sure we would get back up to 16000. This position was up $2.8K at one point, which would have been my biggest winner ever. Of course, the market failed the 3-day balance breakout and M period pushed us down, where I watched my profits fall back to breakeven. At that point, it was just revenge trading trying to catch any green, for another 500-700 or so in loss. I didn’t even know what I was doing anymore. None of this should have happened, right? Well, let’s look at what rules I set in my last post:

2 MNQ for all of November, if November is also green, the reward is to trade 3 MNQ for December :)

No more EU sessions

Trade probabilities provided by my AMTJOY tool, 2:1 RRR with at least 50%+ historical probability - confirmed with price action and cumulative delta (order flow)

Set trade and wait for stop, breakeven, or profit target

Really I’m just a clown at this point. I haven’t followed a single one of those rules, and so I really don’t deserve or should have expected any profits anyway.

The bottom line is this: if I don’t get my head in order, if I keep breaking rules, I will quite literally be forced to leave this game forever. That’s it. It’s that simple. I’ll just go back to those passive-managed funds and my precious Fidelity that get made fun of so often on fintwit. Become another statistic of a failed trader.

Blessed for the Holidays

The reality is that I still feel blessed to have had this opportunity - and hopefully to have it in the future. Even after telling my wife and my family and friends this holiday, while some will be a bit shocked (naturally), they are always supportive in every way possible. Even I have to admit that in the end it really is just a number on a screen. I guess really the only person who still feels like a failure is me. However, I think this may be a flaw in my character itself - being red or “losing” on the day is what causes me to keep overtrading and trying to get back to breakeven for the rest of the session. I’ve heard from many that trying to expect a green day every single day is a huge wasted effort, and also just simply impossible.

A huge thing I want to change in 2024 is to spend more time with friends and family. I spent a vast majority of this year staring at screens, and while I wouldn’t trade (heh) what I’ve learned so far about markets for the world, I have to admit at some point enough is enough, and in 2024 a big focus for me will be spending more quality time with loved ones.

For 2024…

I still have about $900 in my account, just enough to safely trade 1 MNQ. I think that’s what I’ll do in 2024. Try and build my stake back. $4500 is 2250 MNQ points - a hefty amount. But it’s a challenge I’m ready to take. But until 2024, I want to become a stronger and better person, reflect and review on everything this year (both in trading and outside trading), and figure out how to come back even stronger.

Happy Holidays & Cheers

With all that said, I’m looking forward to getting away from the markets and spending time with family and friends for the rest of the year.

Here’s to you and yours, wishing you all a wonderful holiday season.

Until 2024.

- Bad to Break Even Back to Bad MNQ Trader