Another Day, Another Apex Account Blown

Just when I was strarting to "get it", I threw it away... a tale as old as time...

How It’s Going

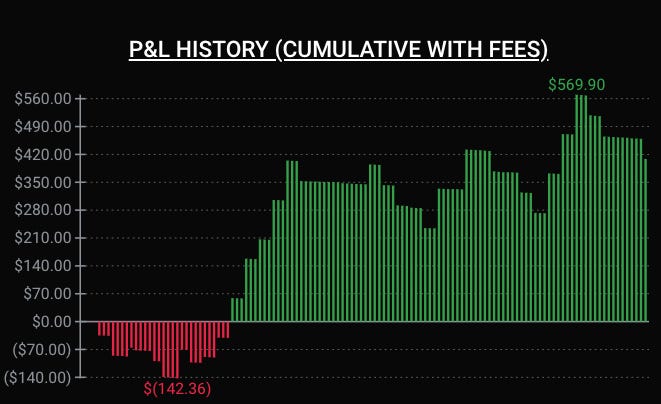

October started out great! I was cracking away at my 100 trade challenge on a new Apex evaluation account, and my equity curve looked like this:

This is 41 trades with 1 MNQ. (9 of those 50 were in my real account, as I’m going to build back some bad losses on NQ with a single MNQ as punishment). With 41 trades equating to ~$420 in profit, that represents a 40% win rate with about 2 RRR, or a 48% win rate with 1.5 RRR. I’m really proud of those statistics! And that equity curve!

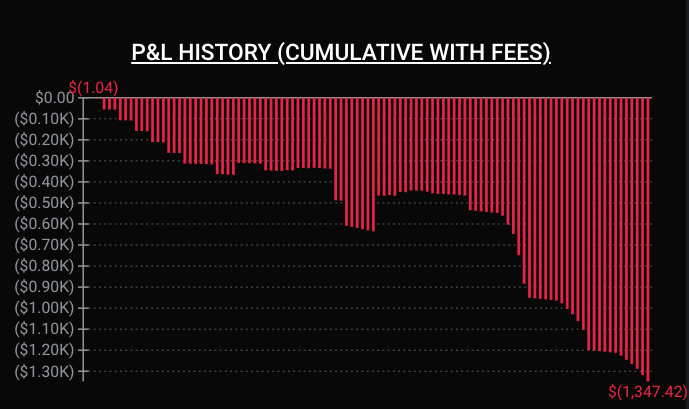

Of course, I obviously wouldn’t be journaling this post if it was all smooth sailing into the sunset. (After all, I am a Bad MNQ Trader). On CPI day, after a stop out in the EU session, I started out the RTH session with 3 more stop outs on attempts at opening range breakouts (already a rule break: I was supposed to be allowing only 2 trades per AM, 2 per PM). My ego couldn’t handle these stopouts and I was unable to leave the session. As a result, I ended up doing this to blow my account:

All previous 10 days of trading profits gone, and every rule broken. In all reality, it’s really only $16 gone for the Apex account. But the mental and emotional cost is far worse:

Letting down mentors and myself.

Breaking my rules.

Totally destroying progress and data collection for the 100 trade challenge.

Trading like a child and not a professional.

Looking stupid.

The list goes on and on.

Hope is (Somehow) Still Afloat

Still, there’s always a silver lining to everything, right? Through the first half of October, I realized even more about my trading:

I absolutely suck at EU sessions, or at least recent ones, and actually I hate them anyway :) We’ve had some small ranging EU sessions the past few days, like 50-60 points. This sounds like a lot but if your profit target is 50 points, you need to be extremely lucky, psychic, or just damn good to hit targets. Won’t be trading EU anymore. It also helps me save mental capital for RTH.

Staring too long at screens, raging at price action I can’t control (read: the entire first half of the CPI session)

I can’t trade while I’m commuting somewhere or otherwise not fully vested in the session. This one seems like its obvious now that I write it but it took me a bit to realize that I don’t think I’ve ever had a winning day when I wasn’t focused at a desk.

Reducing attempts at opening range breakouts. OR breakouts can work really well, except when they don’t. I have to review my trades further but I guess OR breakouts are not my best trades. They incite FOMO in me (because I feel like I NEED to be at every open otherwise I’ll miss an opportunity). I think its good to have these breakouts strategies in my back pocket, but I’ll need to see some pretty definitive price action to take these types of trades in the future.

Patience to enter. Even after seeing a setup, I should set limit orders to get the price (and subsequent stop and target) that I want, not what the market wants. I should know by now that NQ / MNQ almost always chops enough for you to get the fill you want, but too often I FOMO into positions with market orders, afraid I’ll miss the move. These are rarely my best trades.

Finally, the most positive: I know I can do this now. Looking at that first equity curve, I’ve made lightyears of progress from where I was just a few months ago! I could never dream I could make an equity curve like that in 2023. Behind my weak ego shell somewhere is a profitable trader. It’s literally in the data. I just need to control myself, follow my rules, and have PATIENCE - above all else.

New 100 Trade Challenge

So, with that said, there’s a new modified 100 trade challenge I’ve now given myself, even simpler than the first:

A new Apex 25K evaluation account (goal: $1500)

2 trades per day max in RTH: 1 in the morning (A-E periods), 1 in the afternoon (F-M periods)

2 outcomes only; no more breakevens: 1R loss, or 2R win - this forces me to leave the trade and not monitor it (call me crazy but some of my best trades have been this way). This also forces me to take entries I feel totally good about, where I will quite literally be paying for the trade - I’m liking limit orders more and more here - YOU control your entry, not letting the MARKET dictate your entry. This way, a given day has only 3 outcomes: -$100 (2R loss), +$50 (1R win), or +$200 (4R win). As I type this I’m scared; I really need beautiful entries to do well.

No trading if I’m traveling, we have guests, or I’m otherwise distracted by company meetings, tasks, etc. I need to be fully clear for the session. I need to realize its okay to not be there all the time.

Looking in AMT JOY’s Risk Lab, the empirical formula for my RRR would suggest that I should reach $1500 at about 60 trades, or, with my 2 trade limit, exactly 30 days of trading. If I can get it through my stupid head and only take trades I truly feel are closer to 60-75% winners, then maybe I can do it even faster! (In all reality, it’s just 15 winners - yes, just 15 winners - since I like my 50p profit target, or $100.)

Immediately: Taking A Long Needed Break

To be honest, as of today I think I’m approaching burnt out. I had a panic attack last week, the first time in something like 10 years. I blamed the super strong coffee I was chugging all that morning, but maybe something deeper is going on. Maybe I’m trying so hard to prove myself that it’s actually negatively affecting my trading (go figure). Thinking back, I think I’ve missed a total of 1 single session in the past 4 months, and at that, only missed something like 3-4 opening bells. It’s an ugly addiction. Anyway, I’m going to take the entirity of next week off, so I’ll start the new Apex evaluation on Monday the 23rd totally fresh. (With my luck we’re going to have the biggest black swan event in years - might as well just load up on puts now, not financial advice 😂)

Thanks!

So, that’s all for now. If you’re still around to listen to the ramblings of a Bad MNQ Trader, thanks for your time, and I hope my writings can somehow save you from some trading pain. I’m also drafting that AMT jargon post - I hope it can be useful to everybody; it’ll be out soon!

Best,

Chris